German Chancellor Olaf Scholz is not an economic expert. Nobody expects him to be. However, the head of government of the world’s fourth largest industrialised nation should have advisors to protect him from disqualifying himself in economic issues. He obviously does not have any such advisors. At a citizens’ discussion in East Germany, the Chancellor remarked that the lack of new housing construction was partly due to “a psychological problem caused by a rapid rise in interest rates in recent years”.

Either the chancellor believes that it is not the rise in interest rates as such that is a problem, but rather the psyche of those who want to borrow a few hundred thousand euros to buy or build a house or flat. Then he really can’t be helped. Or, he knows how problematic the rise in interest rates is, but doesn’t want to say it clearly because then he would have to deal with the ECB’s policy objectively, which he would like to avoid.

Politics blind to the obvious

However, the Chancellor is not the only one showing this aversion to engage in conflict with the ECB. The entire German government is blind and deaf when it comes to the question of why the German economy is on one of the longest downturns in many decades since the Corona shock. It would rather discuss too much bureaucracy or too little competitiveness than address the question that is really at stake.

The question is how it can be that a temporary price shock, which has now been overcome, can cause the German economy, and with it the entire European economy, to suffer for years. In particular, the decline in investment activity in the construction industry and in all other sectors will cause massive damage to Europe not only in the short term but also in the long term given the many challenges – not to mention the political consequences.

The economics and finance ministers claim in rare agreement that Germany is no longer sufficiently competitive (quoted here). We don’t know what they base their assessment on, apart from complaints from business circles. They don’t talk about the obvious either, but about the trivial. Although German exports are weak, imports are even weaker. This is not evidence of low competitiveness, but of a lack of domestic and foreign demand.

Germany’s foreign trade surplus is expected to exceed 200 billion euros this year and increase in relation to gross domestic product (GDP) compared to 2023. Last year, it amounted to over 4 per cent of German GDP and was more than twice as high as in 2022. This was due to the improvement of the terms of trade as a result of the falling prices for fossil fuels – German competitiveness therefore increased in 2023. The per capita trade surplus in Germany this year will be around four times higher than in China. Do we want to increase this surplus once again by boosting German competitiveness and provoke countries such as the USA to introduce even more protectionist measures?

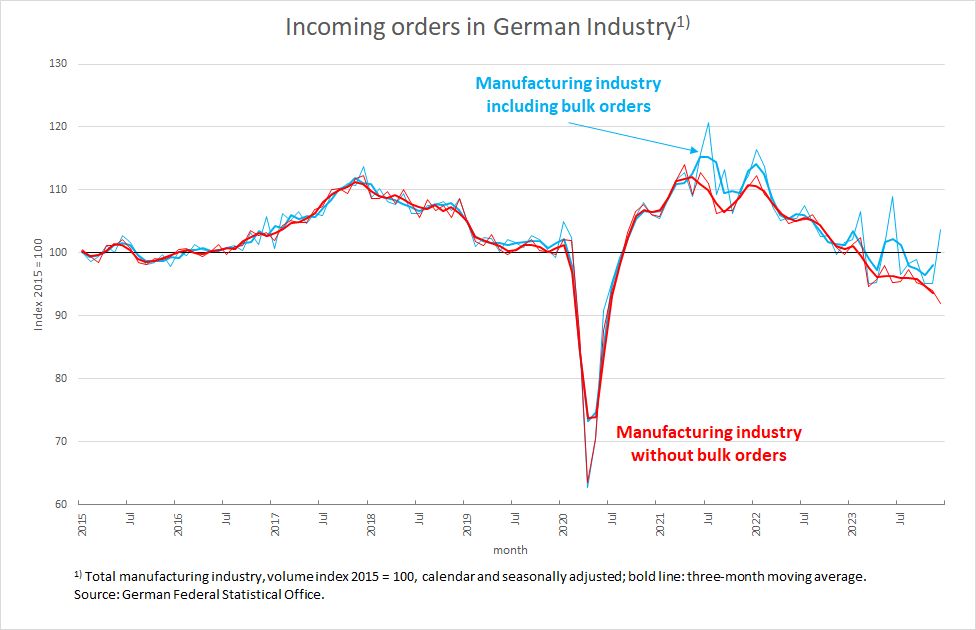

The ifo Institute has just reported that the number of companies in Germany reporting a lack of orders rose from 20 to 37 per cent in January compared to the same period last year. This is a clear indication. The mechanical engineering sector is complaining about declining demand at home and abroad. Incoming orders in industry as a whole are clearly declining – both domestic and from abroad, as we illustrate below in Figures 2 and 3.

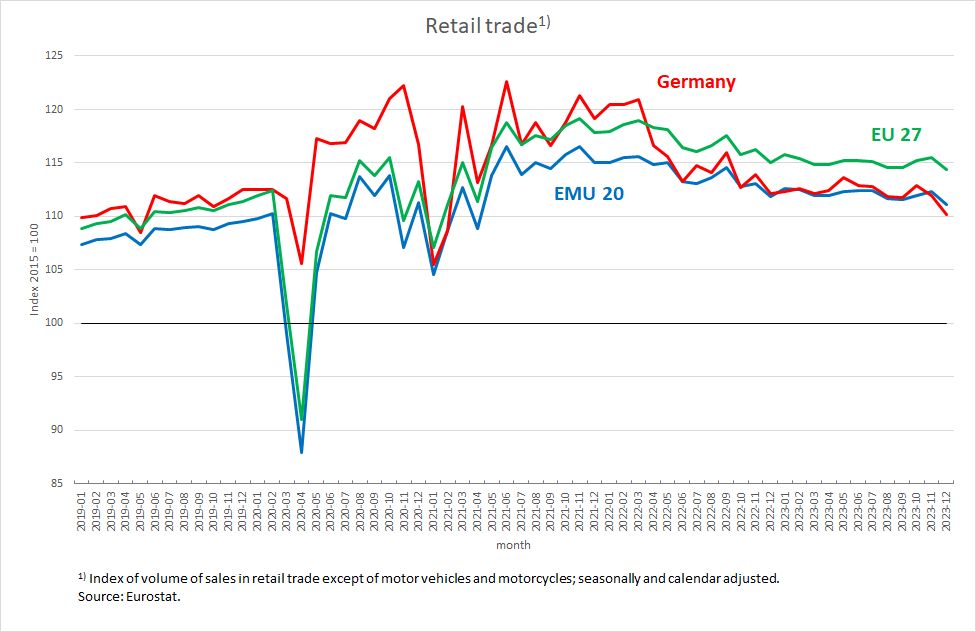

The retail trade sector in Germany and Europe is also facing stagnating demand for a year following the significant decline in the first half of 2022 due to the war in Ukraine (Figure 1). Although Germany’s retail trade recovered faster than that of most other countries after the Corona shock, the lead has disappeared, and it seems that Germany is now dragging the rest of Europe down with it.

Figure 1

Economic advice and the media blind to the obvious

But even “leading” economists are in no way inferior to politicians when it comes to lack of clear analysis. The president of the aforementioned institute, which identified the sharp increase in order shortages in January, stated as recently as December 2023:

“There are, if you like, two types of recession. One is a classic recession, a recession driven by weak demand: demand falls and companies can no longer get rid of their products. Then, it is problematic if the state also reduces demand. However, this is not primarily the recession we are experiencing. You can recognise this by the fact that we have weak economic development – not a real recession at the moment – but we do have high inflation. In other words, we are in a stagflation situation. And when inflation is high, there is a shortage of all kinds of things, but not of demand. So if the state continues to reduce demand, this is not a problem because we don’t have empty capacities that are then even more underutilised, but rather inflation will fall slightly. You can also see this from the fact that we have low unemployment at the moment.“

That’s great. Although Clemens Fuest recognises a “classic recession driven by weak demand”, he is unable to distinguish between classic, demand-driven inflation and a temporary price increase triggered by supply shocks. Consequently, he was completely wrong in his assessment of the situation, as his own institute has now confirmed, and accordingly gave completely wrong advice.

The inability to deal with the economy in a factually sound manner is also reflected in the confusion that haunts the media every day. The absurd thesis that increasing sickness absence caused the recession last year made it into the daily news with a long report. It can be ruled out that companies that have far too little demand would not be able to meet the existing demand due to employee illness, even though their capacities are underutilized. Every company has the scope to make up for production lost due to increased sickness reports over the course of the year.

Apparently there is a lack of expertise among economic reporters: In national accounting, gross domestic product is calculated in three ways: on the production side (how much is produced?), on the utilisation side (how much is demanded?) and on the distribution side (who earns how much?). If an above-average number of workers are ill, this may hinder production. If demand cannot be adequately met as a result, inventories would have to fall and price increases would rise. According to calculations by the Federal Statistical Office, neither was the case in 2023: inventories increased by 64 billion euros (that’s 1.5 per cent of GDP) and the rate of price increases is on the decline.

The downturn is dramatic

The downturn in German industry has been going on for two years now. Incoming orders in the manufacturing sector have been falling since the beginning of 2022 (Figures 2 and 3). The indices excluding bulk orders (the red line in Figure 2) show an almost continuous decline; the bulk orders mask the underlying trend only temporarily.

Figure 2

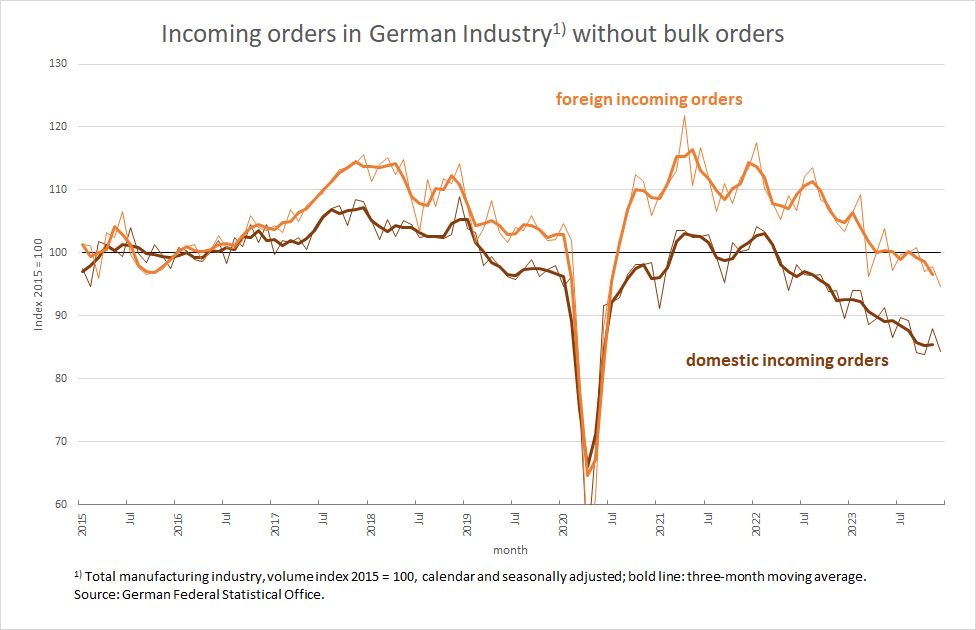

Figure 3 shows that foreign demand is comparatively still a pillar of the German economy. Following the Corona shock, foreign demand rose far more strongly than domestic demand and, despite the sharp decline, is still close to the 2015 level, while domestic demand is now 15 percentage points below the 2015 level.

Figure 3

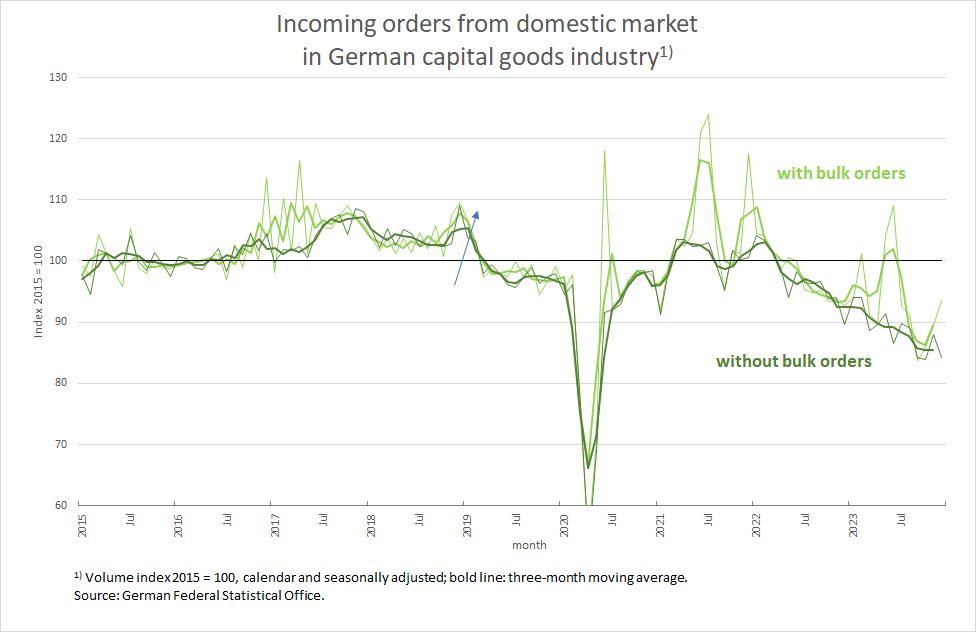

The situation with regard to investment demand is also dramatic (Figure 4), although Germany needs nothing more urgently than rising real capital formation. The most important indicator of domestic investment activity, domestic demand in the German capital goods industry, has slipped by around fifteen percentage points since the beginning of 2022, just like overall domestic industrial demand, with no signs of a turnaround.

Figure 4

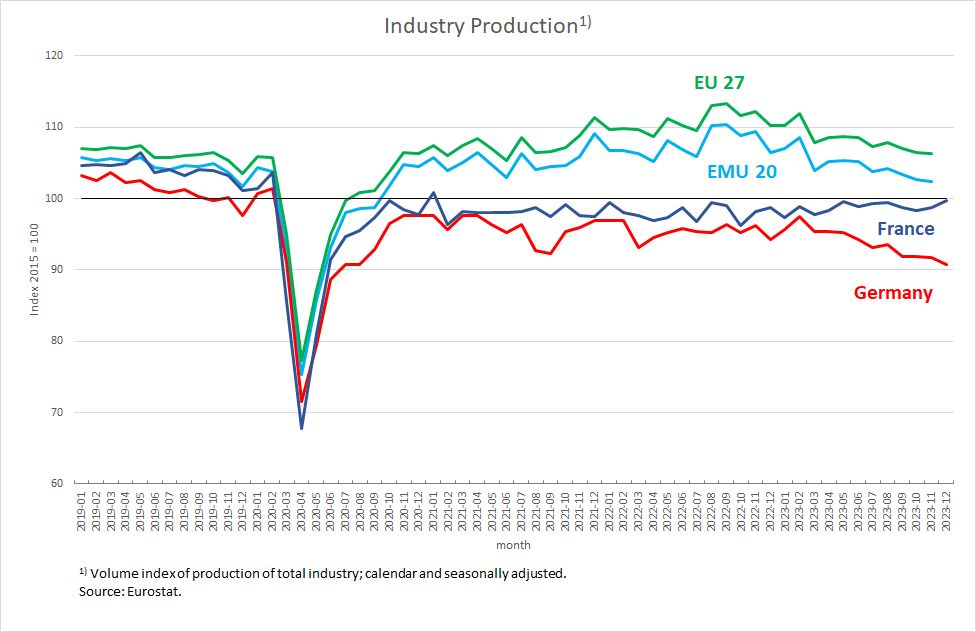

The trend in industrial production (Figure 5) shows the extent to which Germany has decoupled itself from Europe in terms of industrial development. This has to do with the fact that Germany, as the most important producer of capital goods, has been hit particularly hard by the permanent European slowdown (the reasons for this are described here) and the global turnaround in interest rates. France, for example, is stagnating at the 2015 level and is thus holding up much better, presumably because the government is pursuing a much more sensible fiscal policy course.

Figure 5

Germany and Europe urgently need a turnaround in economic policy. But Germany is preventing this both within the ECB and in Brussels.

The “beast” is dead, but nothing has been gained

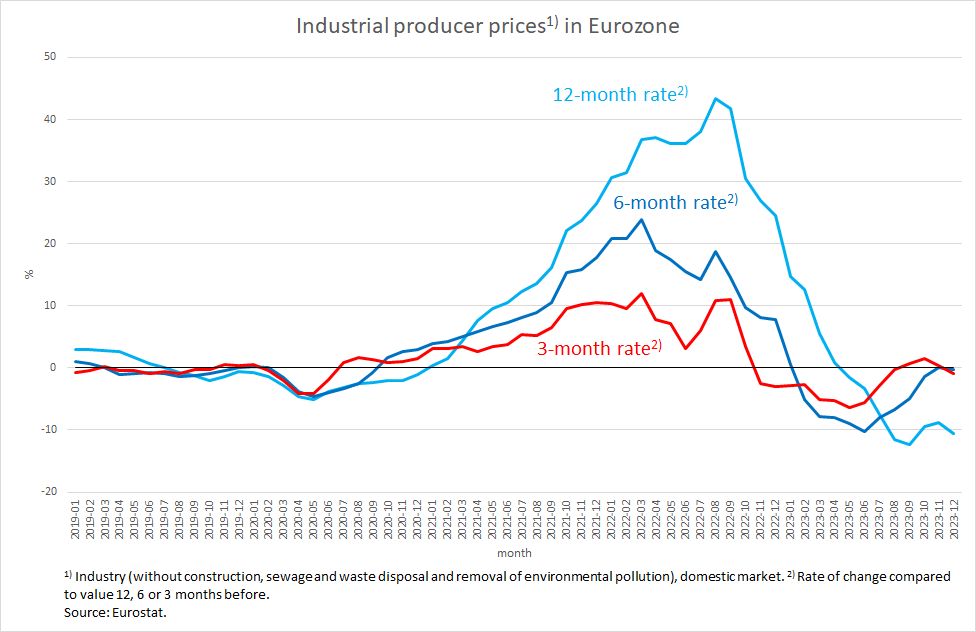

In recent months, we have often explained why the diagnosis of “inflation” does not apply to the temporary price increases of recent years (most recently here). From month to month, the statistics are now showing more clearly that the high rates of price increases are a thing of the past. This is absolutely evident at the level of producer prices in EMU industry (Figure 6). The figure shows that the dynamic of price increases has been completely broken. Whether you calculate over twelve, six or three months, there is no upward price momentum in industry in the sense of a renewed risk of acceleration. Rather, a deflationary trend below the ECB’s inflation target is to be expected.

Figure 6

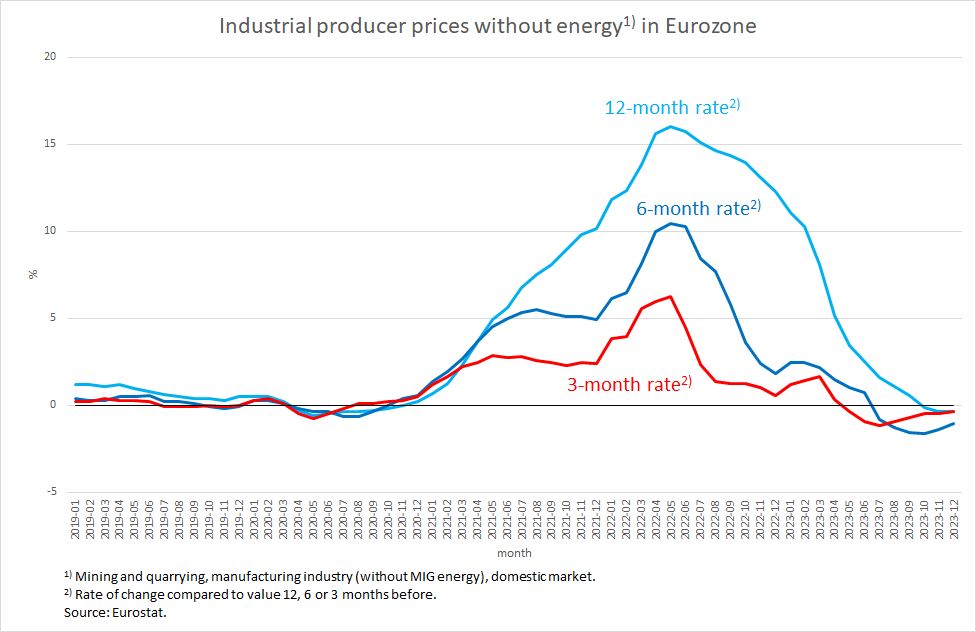

This also applies to producer prices excluding energy (Figure 7). Here, all three rates are converging below zero, which shows that there are no price increases in the pipeline that would endanger the achievement of the ECB’s inflation target.

Figure 7

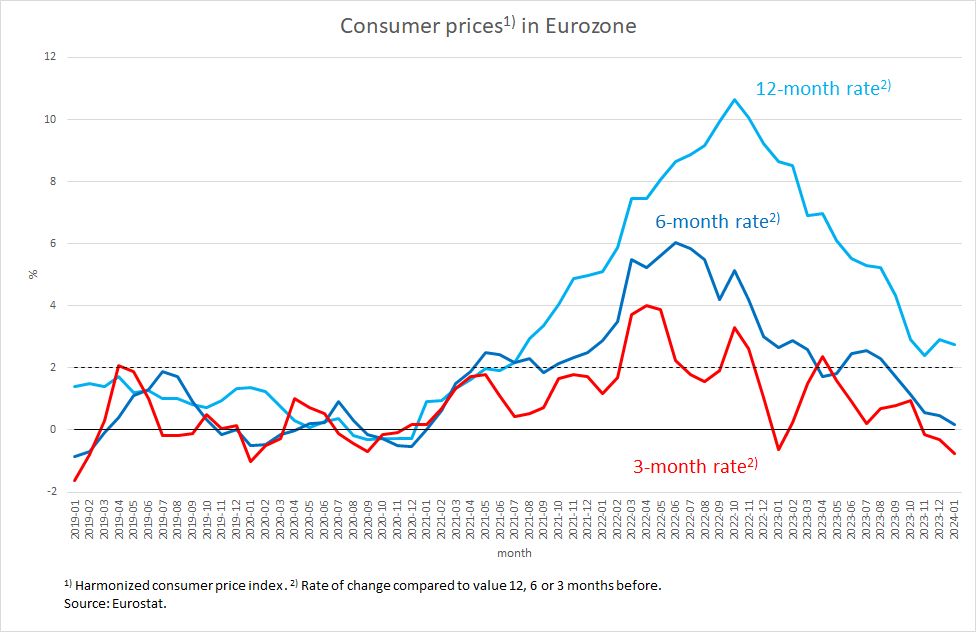

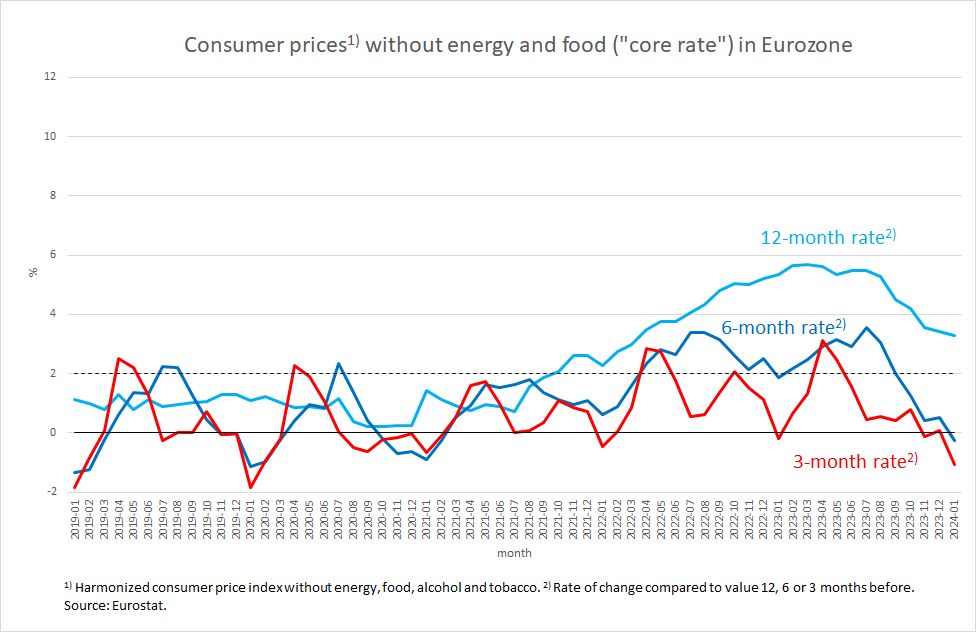

The same pattern can be seen in overall consumer prices and in the so-called core rate (i.e. excluding energy and food) (Figures 8 and 9). Only the 12-month values are still above the inflation target in both figures. However, this has no significance for the inflation dynamics, as the two more short-term indicators show that this dynamic is developing in the right direction or even overshooting in a downward direction.

Figure 8

Figure 9

The failure of the ECB

The fact that the ECB leadership does not use such graphs, but stubbornly sticks to the previous year’s rates in its communication strategy, shows that it has no real interest in making the important processes transparent and explaining them. It wants to defend its rigorous approach at all costs and cheaply distract from the fact that it has been wrong in its assessment of a real risk of inflation since the beginning of 2022. Even now, it can be said that the idea propagated by the ECB leadership that the European inflation rate will only return to the inflation target in 2025 without further external shocks is a complete misjudgement.

When Joachim Nagel, the President of the German Bundesbank, said at the end of January that the ECB had tamed the “greedy beast” of inflation, he was not only using inappropriate language, but also suggesting that a considerable sacrifice in the form of an economic setback was appropriate in order to tame the beast. This is an assertion that is flatly refuted by developments in the USA. The course of price development in the USA largely corresponds to that in Europe (as shown here). There, however, the downward oriented price rates have occurred without any economic setback. Apparently, there was no need for a drop in demand. Because the US government has pursued and continues to pursue an extremely expansive fiscal policy, the restrictive effect of the Fed’s interest rate hikes was more than offset. Nevertheless, price developments calmed down.

The ideas of the President of the Austrian Central Bank, Robert Holzmann, are even more absurd. In an interview with the FAZ newspaper, he talks about a savings surplus among private households, which has been reduced by high inflation, but “is still there in real terms”, which in his eyes harbours inflationary potential. One wonders why this alleged savings surplus is not currently reflected in at least constant private consumer demand and when it might materialise again in such a way that companies start to increase prices more forcefully. Private households are clearly behaving pro-cyclically – and this is precisely the problem that the economy is facing and that politicians, including the central bank, should solve and not exacerbate.

How little this central bank chief understands the actual context is revealed even more clearly by the following answer to the question of where he still sees upward potential for inflation: “And last but not least, there has been turbulence in China with a considerable destruction of financial assets. These are huge shifts that could also have an impact on economic development in this country.” The average FAZ reader presumably has no doubts about the interviewee’s competence in the face of this nonsense: China – turbulence – destruction of financial assets – danger for us? This all fits into the flat world view of the threat from the Far East, so why not also use it as a reasoning for inflation concerns, which the ECB so urgently depends on in order to defend its absurd course?

The only strange thing is that the FAZ editor, as a die-hard monetarist, does not ask why a destruction of financial assets, i.e. a reduction in the global mountain of money that monetarists believe exists, should lead to inflation? Even if you don’t believe in a mountain of money, one would have to ask Robert Holzmann why economic difficulties in China should lead to inflation in our country. After all, if our exports to China fall, this reduces the capacity utilisation of the German export industry – not a reason for price increases. And if Chinese companies want to boost their exports to overcome their own economic weakness, they are unlikely to do so by increasing prices.

Robert Holzmann is in favour of no interest rate cuts in 2024 or at best only towards the end of the year. There is no justification for this position. This interview directly demonstrates how weak it is. If it is realised, it will cause enormous damage in Europe.