(A shorter version of this paper has been published by the LSE blog today)

Inflationary dynamics cannot be effectively addressed by conventional measures or a radical market shock therapy. Comparing the developments in Argentina and Turkey, we argue that the only way to address the problem is through cooperative behaviour of the government, businesses, and trade unions – supported by reforms of the international monetary and financial architecture. Milei’s ideas, however, will merely unleash even greater destructive forces.

Argentina’s economy is once again at the forefront of economic debates. Since the election of a president who wants to drastically reduce the size of the state to “unleash the powers of the markets”, the economic headwinds have changed substantially and resemble the intellectual weather conditions of the 1970s and 1980s. Javier Milei insists that there is no alternative to a radical market economy to lead his country out of decades of mismanagement.

In this article, we want to ask the simple question of how Argentina’s central problem, extremely high inflation, is to be tackled by the “markets”. Thereby, we use the contrasting example of Turkey, which is also much (and wrongly) discussed in the media, to show why it is almost impossible to return to moderate inflation anywhere in the world using the orthodox means of monetary policy.

Argentina – The status quo

2021 marked the 20th anniversary of Argentina’s dramatic sovereign debt default of 2001. At that time, just barely over two years ago, it took over 100 Argentine pesos to buy 1 US dollar. It is worth recalling that the Argentine peso is the currency that the government wanted to trade “forever” at a rate of 1:1 against the dollar in the early 1990s.

Following a massive devaluation at the beginning of this year, the mark of 800 pesos to one dollar was exceeded. This illustrates how desolate the situation in Argentina is. While a devaluation on this scale could give the country some breathing space, as exports become more price competitive and imports become more expensive, in Argentina, the devaluation will further exacerbate the situation, because foreign debt can hardly be serviced and inflationary pressure will continue to rise, given that Argentina mainly imports energy, food and intermediate products for further processing. Hence, in short, without a solution to the inflation problem, this peso exchange rate is just another step on the road to a decline the likes of which the world has not seen for decades. How the new president intends to reduce inflation is completely unclear, as apart from his religious belief in the magics of the market – which is applauded by the International Monetary Fund (IMF) as well as conservative and liberal commentators and politicians in the west – there is little he has intellectually to offer.

Indeed, looking at economic development in Argentina over the past decades, there is little doubt that the story is one of an almost continuous decline. In the first years of the 2000s, Argentina grew strongly because it had ended its major currency crisis in 2002 with a dramatic devaluation and exports exploded. However, after the global financial crisis of 2008/2009, the country was never able to return to a growth trajectory. Neither where the left-wing governments nor the conservative Macri government (2015 to 2019) able to turn the tide.

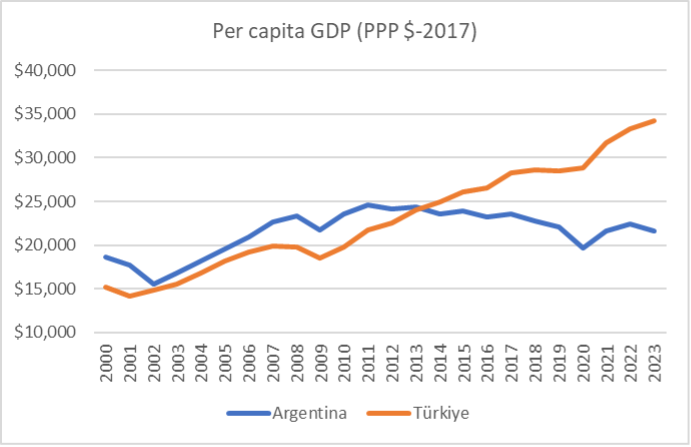

Figure 1 shows the real GDP per capita in Argentina and, in comparison, Turkey. Both countries have been struggling with high inflation for several years and seem unable to find a way out. However, the difference in real development is enormous. While real GDP per capita in Argentina is now well below the 2011 figure, Turkey has achieved considerable growth despite the recent high inflation rates.

Figure 1

Source: IMF (2023)

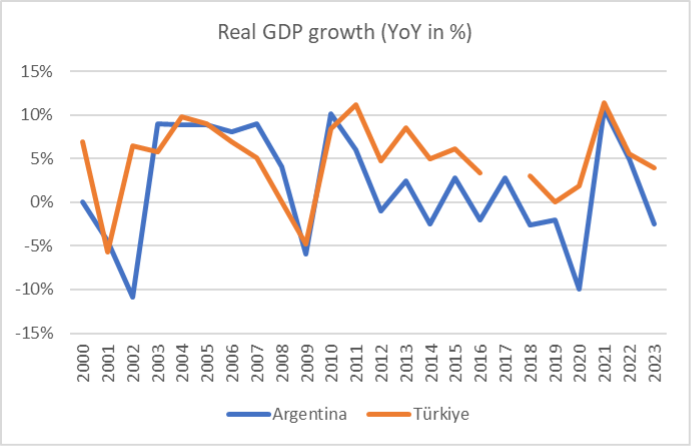

The absolute real growth rates of GDP in Figure 2 further underline that, after the years of the global financial crisis, Argentina was never able to move away from stagnation and had to cope with a severe recession in 2018 and 2019 (under the conservative President Macri), i.e. during the years just prior to the Covid-shock. Last year, the recovery from the Covid-shock was already over and another deep slump followed. In contrast, Turkey recorded consistently positive growth rates after the financial crisis and even managed to avoid a slump during the coronavirus pandemic. However, there was a noticeable slowdown in growth rates between 2015 and 2020.

Figure 2

Source: IMF (2023)

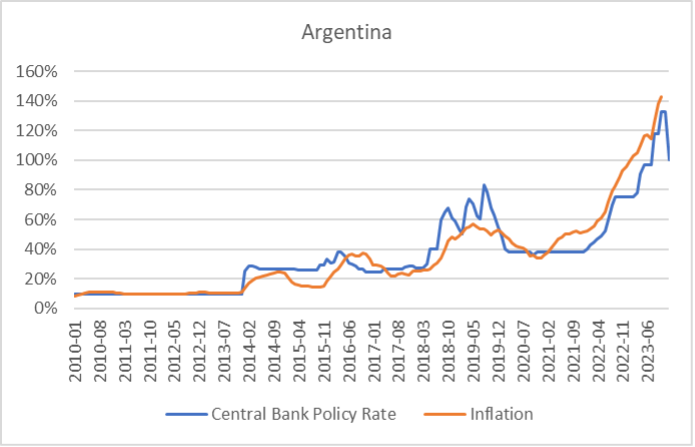

The key difference between Argentina and Turkey lies in the different macroeconomic conditions and in the economic policy response to inflation in the two countries (Figures 3 and 4). In Argentina, the central bank followed every swing in the inflation rate with an interest rate hike. During the 2010s, nominal interest rates remained – for the most part – even above the respective inflation rates. According to the prevailing economic doctrine, enforcing such a positive real interest rate is the only way to successfully combat inflation. Evidently, however, the operation did not succeed, as inflation accelerated from 2022 and the interest rate decoupled from the inflation rate more recently. Yet, nonetheless, Argentina still has an interest rate level of almost 100 per cent.

Figure 3

Source: BIS (2023)

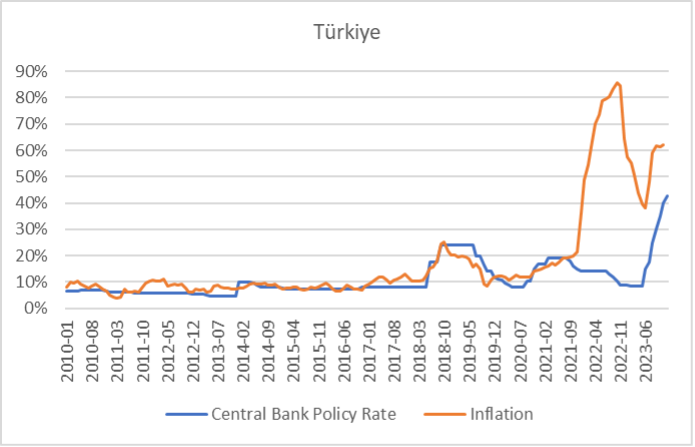

Compared to Argentina, the case of Turkey is quite different. Here, too, the initial roadmap was that interest rate policy should at least follow the rate of inflation. However, at the end of 2021, the president decided that this policy was not appropriate due to its impact on growth and ensured that the central bank’s interest rate remained well below the inflation rate until the beginning of 2023. After two years, however, this experiment was also ended because it was of course unable to prevent further inflation. Since mid-2023 – after inflation had already fallen from its peak of 85 per cent in autumn 2022 to 38 per cent – Turkey has returned to an orthodox interest rate policy and the interest rate is now above 40 per cent.

Figure 4

Source: BIS (2023)

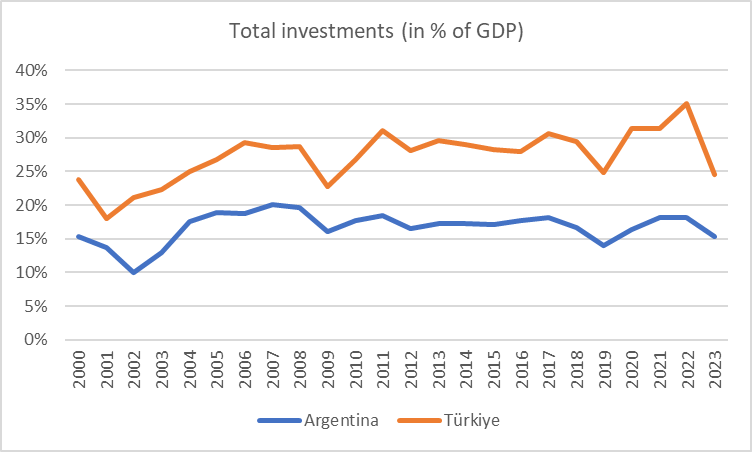

Generally, however, the overall better macroeconomic conditions – lower interest rates with lower inflation rates (which improved the predictability and certainty of planning investments) – were the basis for the investment ratio in Turkey to be significantly higher than in Argentina (Figure 5). While the investment ratio in Argentina was mostly between 15 per cent and 20 per cent of GDP, it mostly scratched the 30 per cent mark in Turkey – even if the rate hikes of 2023 clearly left a mark.

Figure 5

Source: IMF (2023)

What triggered inflation?

The attempt in both countries to combat very high inflation with restrictive monetary policy and ever-increasing interest rates has failed. Even a deep recession, as in Argentina, and a significant slowdown in growth, as in Turkey, have not led to a slowdown in the pace of inflation. The reasons for this are easy to understand, but they do not fit the theoretical ideas of neoclassicism, monetarism, or other forms of liberal phantasies.

Indeed, the inflationary phases in both countries were by no means triggered by a particularly lax monetary policy but were usually caused by devaluation surges that impacted the domestic economy via imports. The three significant increases in interest rates since 2010 (2014, 2018 and 2022 in Argentina and 2023 in Turkey) did not occur by chance almost simultaneously. The first significant interest rate hike at the beginning of 2014 – from 9.5 per cent to 25.5 per cent in Argentina and from 4.5 per cent to 10 per cent in Turkey – followed the change in US monetary policy (known as the taper tantrum) in the summer of 2013. The second increase in 2018 – interest rates rose from 27.25 per cent to 60 per cent in Argentina and from 8 per cent to 24 per cent in Turkey over the course of the year – was also an attempt by the central banks to halt a spiral of devaluation as a result of an interest rate turnaround in the US.

Both Turkey and Argentina are heavily dependent on global refinancing conditions, as the stability of the external value of their currencies depends on them. Empirical studies, including by UNCTAD (here), show the full extent of these dependencies, which also exist in other countries (for example in Pakistan or Nicaragua).

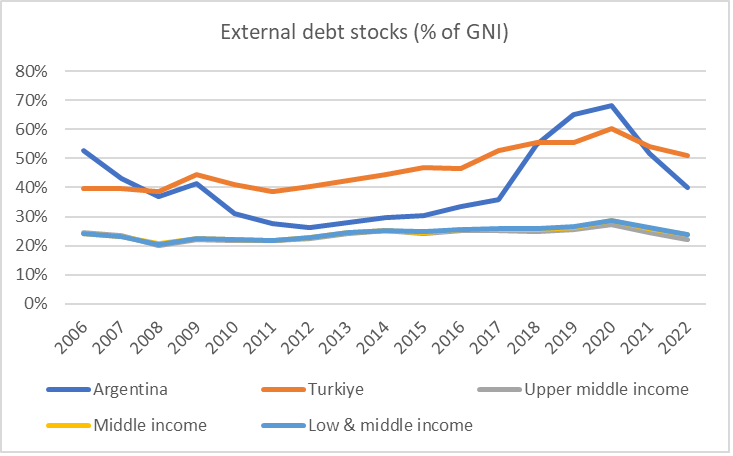

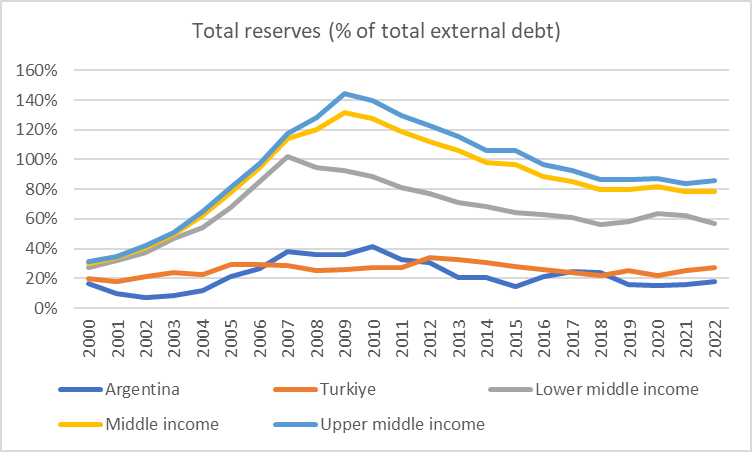

The reason for this vulnerability lies in the very high levels of external debt, which is also barely covered by foreign currency. Figures 6 and 7 show the extent of this particularity in Argentina and Turkey, both in relation to the respective indicators for lower-middle income, middle-income, and upper-middle income aggregates.

Figure 6

Source: World Bank (2023)

Figure 7

Source: World Bank (2023)

The high level of external debt affects both the public and private sectors. The share of public foreign debt in GDP was most recently (2021) just under 24 per cent in Argentina and 17 per cent in Turkey. By comparison, the share in developing countries as a whole is just 9 per cent. Additionally, around three quarters of public external debt is held by private creditors (73 per cent in the case of Argentina and 78 per cent in the case of Turkey). Unlike public lenders, private investors and speculators react particularly quickly to changing yield conditions overseas, meaning that financing conditions as a whole are like a rollercoaster ride.

Why does permanent inflation occur after a shock?

A devaluation of the domestic currency usually creates inflationary pressure, as imports become massively more expensive on the one hand and confidence in the domestic currency is lost on the other (which, in turn, has an impact on wage development as workers demand higher nominal payments in the domestic currency). Those who receive their salary in pesos or lira exchange what is left after taxes into foreign currency or invest in tangible assets, such as cars or real estate. The deposits at banks are also often held in US dollars. In Turkey, almost half of the deposits in private household accounts are denominated in foreign currency (most of them in US dollars), in Argentina the figure is closer to 20 per cent – although the amount of savings in foreign currency outside the banking system is likely to be significantly higher.

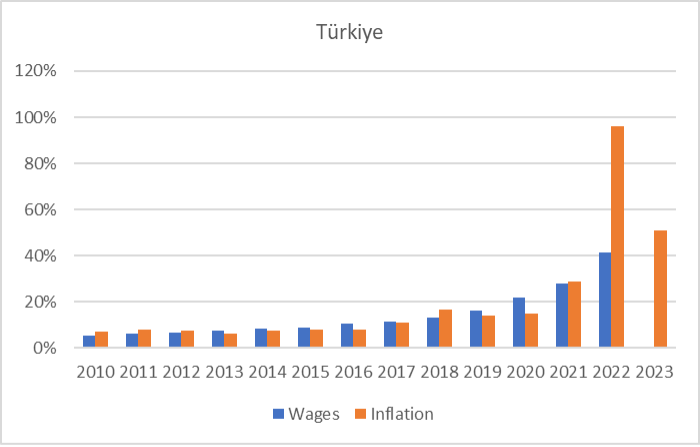

If prices start to rise as a result of such a shock, there is a reaction in wages that sets off an inflationary spiral. As in the major industrialised countries in the wake of the energy price hikes in 2022, this temporary price effects are interpreted as “inflation” by the general public and central banks, which triggers a catch-up process in wages that can ultimately turn the temporary effects into permanent inflation. The minimum wage development in Turkey is a case in point. In January 2023, the government raised the minimum wage by 55 per cent, in July last year by another 34 per cent and in January 2024 by a further 49 per cent (as reported here and here). This was a decision from a government that is committed to fighting inflation and is now fighting inflation with high interest rates. It is obvious: because inflation is high – for whatever reason – wages have to follow, otherwise people will starve, and the economy will collapse due to a lack of demand. However, at the same time, inflation is high and remains high if wages are constantly rising. Price increases and wage increases are mutually dependent. There is no easy way out of inflation because you can neither prevent wage increases as long as prices are rising, nor can you prevent price increases if wages continue to rise. As Figure 8 shows, wages in Turkey have risen faster than prices for several years, but the reverse is also true, especially in the year before last, when inflation surprisingly picked up again.

Figure 8

Source: ILO, World Bank (2023)

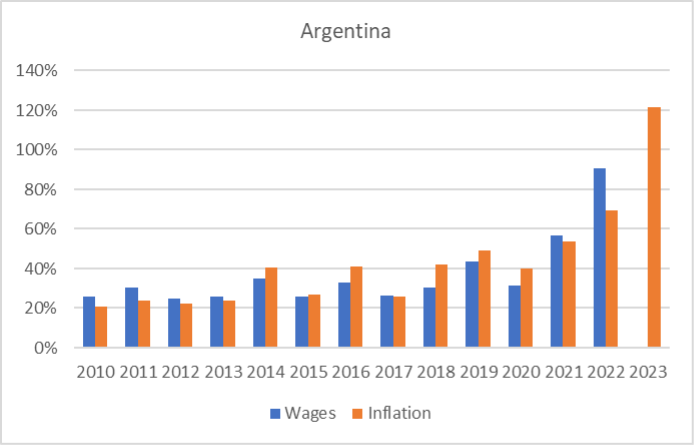

In Argentina (Figure 9), wages have generally risen slightly faster than inflation, most recently by 140 per cent. But this does not change the fact that we are dealing with a mutually reinforcing process in which the question of who wins is decided more by chance.

Figure 9

Source: Ministerio de Economía, World Bank (2023)

What needs to be done

Under such conditions, both labour and capital (as well as the state as the minimum wage setter) block each other because no one can trust that the other side will do the same as they do. The only way out of this kind of prisoner’s dilemma (whoever moves first loses) is if the two sides (companies and trade unions) are persuaded by a third party (the government) to negotiate an exit from the vicious circle of ever new price-wage-price spirals.

This would resemble a sort of currency reform without necessarily having to replace the currency. However, the government must make it clear that it will brutally stop the previous spirals by means of a wage and price freeze if the collective bargaining partners do not agree to negotiate wage increases based on a new low inflation target. At the same time, the government must take measures to ensure that prices do not rise above the desired target. The government can, for example, threaten companies with a unilateral statutory price freeze if the trade unions agree to moderate wage increases.

The activation of wage or income policy by the government is central to combating a permanently high inflation rate. No “market” can stop a price-wage-price spiral once it has started. Restrictive monetary policy is pointless and even counterproductive when price increase rates have become so entrenched. Stifling the economy further reduces the chances of winning over the companies and trade unions that are needed to find a solution for talks with the government. All attempts to ensure the “recovery” of public finances through restrictive fiscal policy are also pointless, as it does not effectively address the source of the actual problem.

For policymakers, it is important to realise that stubborn inflation is always and everywhere a wage problem. As a consequence, it is always a question of politically breaking a vicious circle of price increase shocks and subsequent wage adjustments. With the conventional means of monetary and fiscal policy, this is not possible. On the contrary, the IMF’s preferred approach of first massively weakening domestic demand in any kind of crisis is akin to the attempts of medieval medicine men to fight every disease by applying leeches. Moreover, to keep the external value of currencies as stable as possible, particularly in the countries of the global South, the world’s central banks should intervene in the foreign exchange markets to ensure orderly currency revaluations and devaluations occur. This is essential to curb the herding in financial markets, which often triggers the original inflationary spurts, fuels panic, and leads to an extremely challenging macroeconomic environment for fighting inflationary dynamics.

In any case, however, it is crucial that both Washington and Buenos Aires soon realise that there is no way of combating inflation through deregulation or other liberal brute force measures (such as the abolition of the central bank or dollarisation) without causing even greater damage through a total collapse of the economy. The price for such devastation would be paid for by ordinary and poor households in Argentina – which would add a further and painful episode of suffering to an already long story of malaise.