In Europe, monetary policy is usually discussed as if there were no alternative to the institutional-political design of monetary policy with an independent central bank and its focus on price stability. All European countries have subscribed to the old German maxim that the central bank must not only be politically independent but also almost exclusively committed to the goal of price stability.

What political independence exactly means and how independent a central bank really is in day-to-day political business may be debated at length. But it can hardly be disputed that the world changes fundamentally for a central bank – far beyond the question of formal independence – if it no longer has to pursue price stability as its sole objective.

If it were even proposed in Europe, and especially in Germany, that the central bank be made equally responsible for employment and price stability, there would be an outcry of indignation from 95 percent of economists and from all conservative-liberal forces. That would be the end of the independence of the central bank, they would say, and the beginning of a wave of inflation, because the central bank is always in danger of buying more employment with a little more inflation.

Very clever monetarists would argue that such a mandate already theoretically confronts the central bank with a completely unsolvable task, because there is only a particularly close relationship between the money supply and inflation, but not between any monetary policy instrument and employment. The employers (and the trade unions) would insist on the autonomy of collective bargaining with the argument that it is their task to ensure a high level of employment, after all, they are the ones who set the price on the labour market, which decides on employment or unemployment.

America does it differently

But lo and behold, in the motherland of capitalism, the central bank has been put in exactly this “predicament”. The mandate of the Federal Reserve System (the Fed) is unambiguous:

“Conducting the nation’s monetary policy by influencing money and credit conditions in the economy in pursuit of full employment and stable prices.”

Full employment and stable prices, that is the Fed’s extremely ambitious mission. In comparison, the ECB’s mission statement reads like child’s play:

“The main objective of the Eurosystem is to maintain price stability: safeguarding the value of the euro.”

The American model can never work, people in Europe would claim from very different corners, because the central bank is systematically overstretched when it comes to creating full employment.

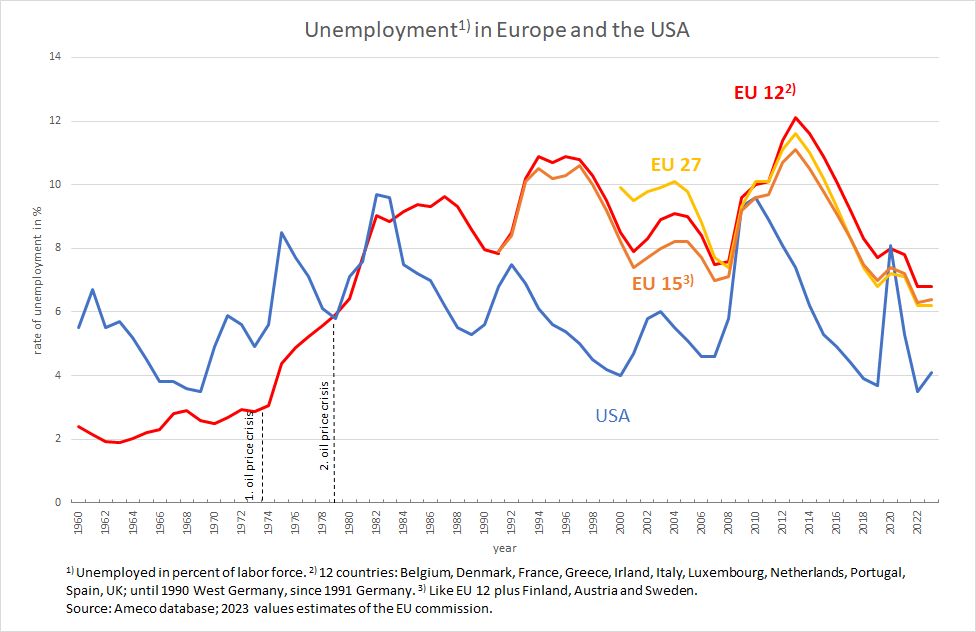

Let’s take a look at the results. Figure 1 shows the development of unemployment in the USA and in Europe. Even though the rates cannot be directly compared between the two regions because of different survey methods, it is obvious that the USA has returned several times in the past 20 years to unemployment rates that were reached in the 1960s. At that time, full employment generally prevailed in industrialised countries, and rates in Europe were also below 4 per cent.

Figure 1

In Europe, there has been no talk of a return to this level of employment since then. Before the first oil price crisis, unemployment on this side of the Atlantic was in the order of three per cent. More than ten percent in the mid-nineties and almost twelve percent after the great financial crisis are evidence of a glaring failure of European economic policy. The fact that there has been a significant downward trend in recent years does not change this. More than 12 million people or more than six percent unemployed are by no means values that speak for a sufficient focus of politics on the goal of full employment or for an efficient distribution of roles in economic policy.

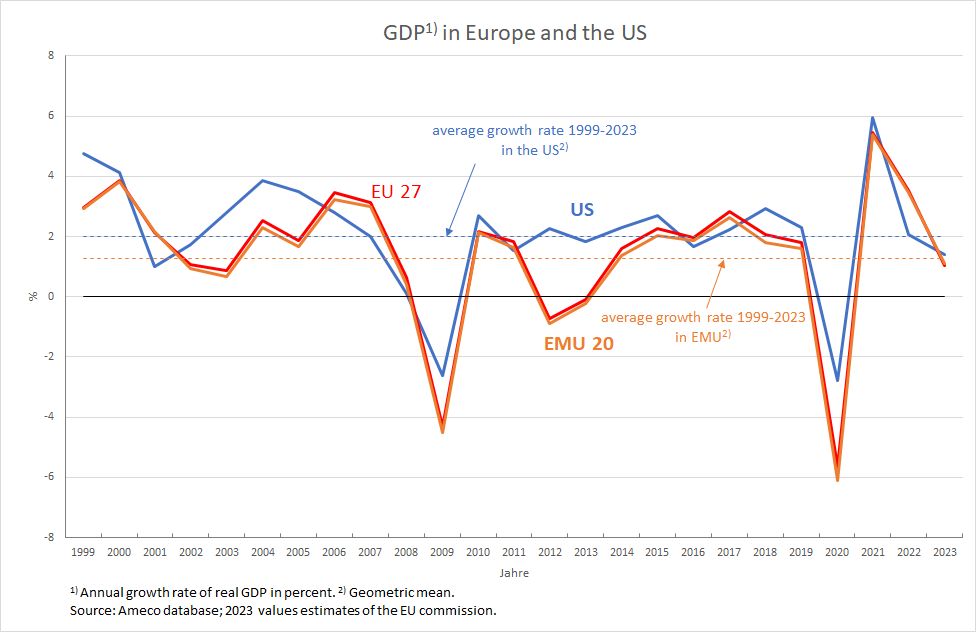

This problem is also reflected in the development of Europe’s overall income compared to the USA. In the United States, the phases of positive economic development over the past 25 years were more pronounced and lasted longer than in Europe, while the crises were milder in this country (see Figure 2).

Figure 2

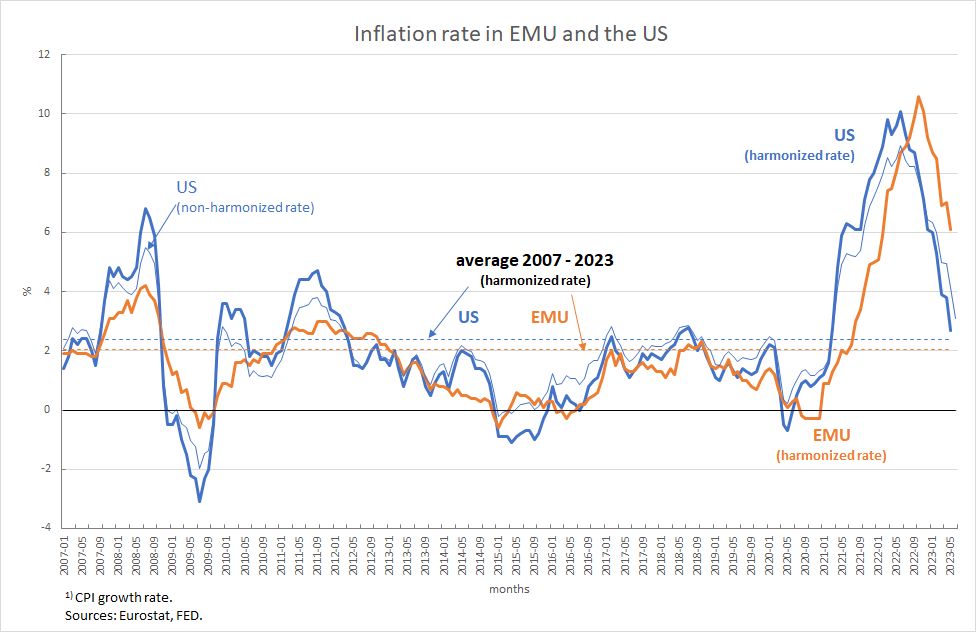

Has Europe been better at price stability? Hardly. As Figure 3 shows, while inflation rates in the US have fluctuated somewhat more since the mid-2000s, on average the Fed has also been able to enforce its inflation target of around two per cent: On average from 2007 to the present, the realised rate of 2.4 per cent (the blue dashed line) is barely above that of the Eurozone at 2.1 per cent (the orange dashed line). Recent price increases have also not been greater in the USA than in Germany, for example. The American (non-harmonised) rate of price increase was very close to the Fed’s target rate again in June, at three per cent.

Figure 3

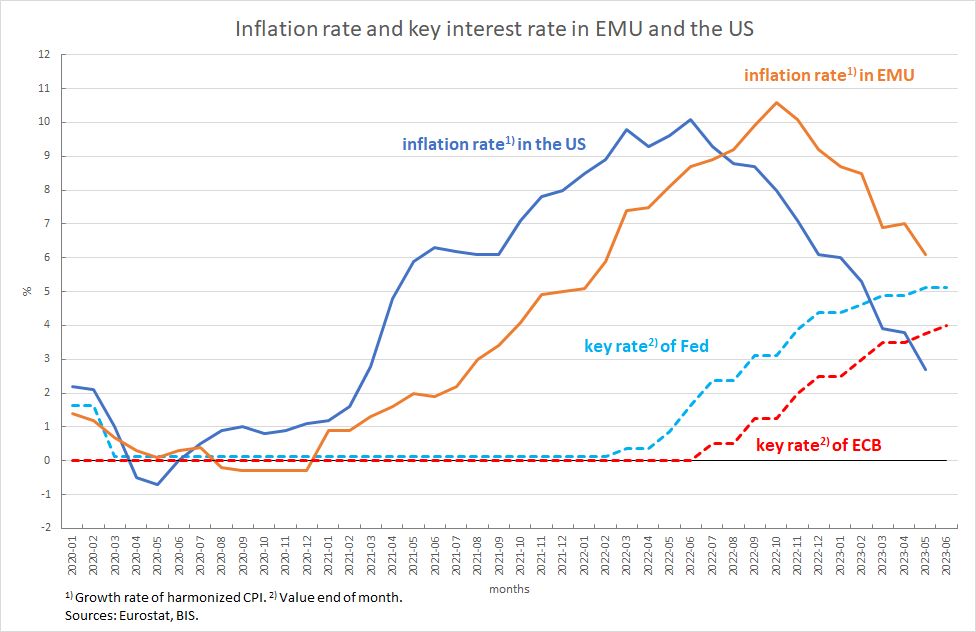

As one can easily see from Figure 4, the American interest rate development was also not fundamentally different from that in Europe.

Figure 4

In its rate hikes since the beginning of last year, the Fed has not been much more aggressive than the ECB, even though the US was very close to full employment and Europe was not. Moreover, the Fed started its rate hikes much later than the ECB in terms of consumer price developments, namely only when the rate of price increases had already been above 5 per cent for almost a year. In Europe, the ECB started raising interest rates after consumer price increases had exceeded the 5 percent mark for half a year.

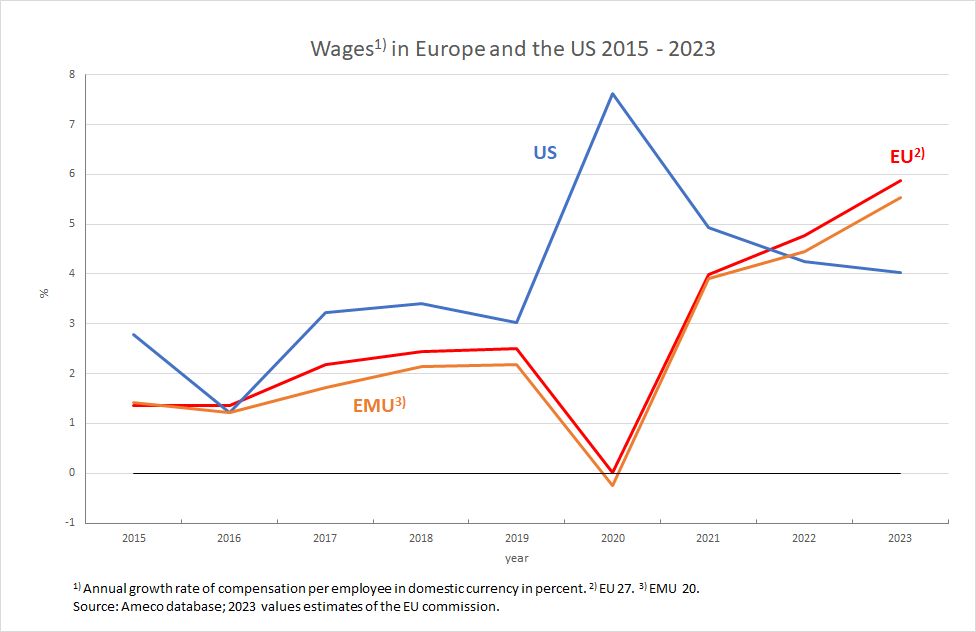

Moreover, the US had a veritable reason for tightening its monetary policy: wages, as Figure 5 shows, had risen much more than in Europe in recent years.

Figure 5

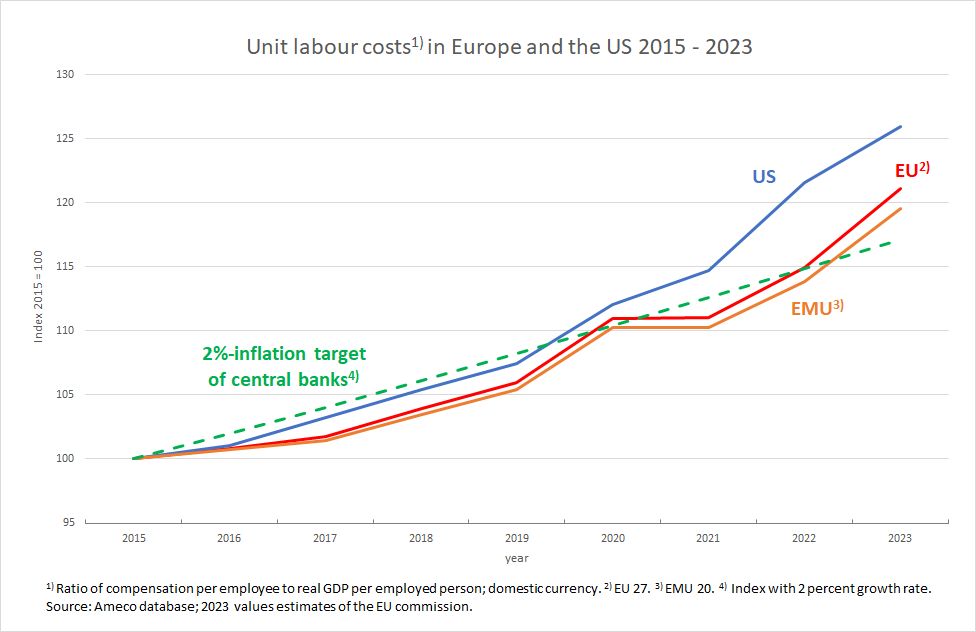

And unit labour costs, which are crucial for inflation, had also grown more in the US (Figure 6). In Europe, by contrast, the strong increase in consumer prices since mid-2021 was clearly based on the consequences of the Corona shock and the energy and food price crisis due to the Ukraine war, but not on excessive wage development.

Figure 6

American pragmatism is superior

So what leads the mainstream to believe that we in Europe have found the only sensible solution for the institutional anchoring of monetary policy? It is probably above all the widespread prejudice, especially in Germany, that a monetary policy that interferes directly in economic policy will ultimately give the state such a helping hand in financing public finances that there will be a constant threat of inflation. The USA shows that this is by no means inevitable.

The debt of the American state has indeed increased significantly in the past ten years, but this, as in many countries of the world, is an expression of the fact that companies are no longer assuming the role of debtor (as shown here). It is precisely this economic “turn of the times” that Europe does not want to take note of.

Apparently, American pragmatism in matters of economic policy is far superior to German/European dogmatism. Not only in matters of monetary policy, but also in matters of public debt and active stimulation of the economy by the state, Europe stands in its own way, while the Americans do what seems necessary according to the state of affairs. Although there are always voices in the USA that warn against too much government debt, almost every government, together with the Fed, has succeeded in creating full employment despite all the crises.