Nothing has a harder time in these days than logic. In a world where almost everyone believes that it is all about the “right” values, the correct speech and what is understood by morality, logic regularly falls by the wayside. In politics one has get used to everything. Although it is undeniable that there is no good politics without logic, party politicians are allowed to say this today and that tomorrow without anyone even attempting to point out the worst contradictions in their statements.

But when the representatives of institutions that are mandated by politics to achieve a certain goal beyond the haze of politics by technocratic means fall into the same linguistic and factual shallowness as the politicians, then it becomes critical. For the representatives of these institutions have the task of enlightening people about the contexts that lie within their sphere of responsibility. Enlightenment, however, requires logic. From an illogical statement, one can derive any proposition and thus also draw any conclusion. However, in a world in which there are fixed factual relationships, arbitrary conclusions do not lead to improvements or even solutions, but to deteriorations.

But this simple fact, which the great epistemologist Raimund Popper once tried to bring home to us in his “Logic of Research”, has been completely lost in the daily blah-blah of politics and the media. You can get away with anything and you are even praised for letting the other person have his or her opinion, even if it is obvious that he (or she) cannot put one and one together. Morality seems to beat logic, although even morality can never be convincing if it disregards basic logical rules. Double standards, for example, are not morality.

The European Central Bank is the classic case of an institution that was given political independence precisely because its representatives were expected to be knowledgeable and to explain to the public in an understandable and thus consistent way what factual relationships underlie their decisions. Especially in the current phase, when the ECB is facing a major challenge, the top representatives should do their utmost to explain monetary policy in easily comprehensible sentences, which means tracing it back to the contexts that currently give rise to inflationary dangers.

The ECB does not explain, it rambles

Let’s take two recent examples. The president, Christine Lagarde, gives an interview to the Indian Times and tries to explain the price increases in Europe. When asked what went wrong in the face of high rates of price increases, she says:

“My predecessors and many central bankers around the world had to fight deflation, and they had to adjust policy as a result of that. More recently, we saw prices rise. And that was largely as a result of higher energy prices and supply bottlenecks. Many of us assumed that it would be transitory as is often the case with supply-driven shocks. But then came the war in Ukraine, and the rarification of supply of oil and gas and the price increases that we witnessed…”

And when asked if the war in Ukraine changed everything, she replies:

“We went from COVID lock down with reduced activity to the reopening of the economy. You suddenly wanted to go to the restaurant or to the bar with friends. There was a surge in demand which was met by restrained supply.”

Both statements are remarkable. At first, the price increases were mainly the result of supply shortages and therefore temporary. But then came the war in Ukraine and a shortage of oil and gas. The first was a temporary shock, but what was the second? The second was also a temporary shock, as we now know, because the prices for gas and oil have already largely normalised. It follows, as I pointed out some time ago, that two temporary shocks are also clearly temporary – or, as Martin Sandbu put it in the Financial Times: “The fact that we have suffered one unforeseen supply shock after another – which no one disputes – is no reason to believe that any of them are not temporary.”

The third sentence about Covid’s consequences is also completely irrelevant. If there are price rises after such a government-induced shock, they too are only temporary, because rising prices in a functioning market economy will just ensure that supply increases. Interest rate hikes that prevent investment achieve exactly the opposite. In other words, fighting the state-induced supply shock with a negative demand shock caused by monetary policy makes no sense at all.

Wages and profits as culprits?

Isabel Schnabel, who is also a member of the ECB Governing Council, surprisingly argues quite differently and tries to blame wages and profits for the expected rate of price increases in the medium term and the ECB’s restrictive course. But this is also absurd. In an interview with Bloomberg she says:

“What is more important when it comes to medium-term inflation is the development of wages and profits. … If we look at our wage trackers, we are seeing that wage growth has picked up substantially. It is expected to be around 4 to 5% in the years to come, which is too high to be consistent with our 2% inflation target even when taking productivity growth into account. Also, given a longer duration of wage contracts compared to the US and a more centralised bargaining process, one could expect wage growth in the euro area to be more persistent. So wage developments are going to be key for our assessment of underlying inflation and therefore also for inflation over the medium term. … The other factor is that the labour market is very strong. We have seen marked growth in employment in the fourth quarter. Surveys show that hiring intentions are strong and rising.”

And on profits, she notes:

“The second important factor is profits. In the past, many firms were not only able to fully pass through their higher costs, but often they were even able to increase their profit margins. So we also need to look at the evolution of profits.”

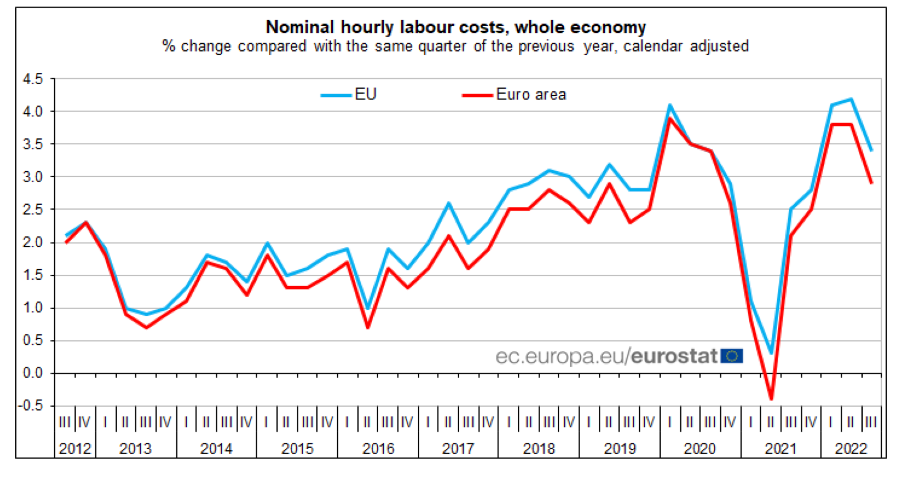

It is true that average wage increases, which for many years were extremely low in the EMU, have recently risen somewhat more strongly, as the graph from EUROSTAT shows. But the growth rates until the third quarter of 2022 (and despite the deep slump during the Corona crisis) are exactly in the range that Ms Schnabel apparently wants, namely between 3 and 4 per cent.

Graph

Looking at the graph, however, one wonders why the ECB, for which, as Ms Schnabel emphasises, wage developments are “of crucial importance” for medium-term inflation, remained silent from 2012 to 2018, even though wage developments were clearly deflationary with growth rates around 1 to 2 per cent. If it considers growth rates of 4 to 5 per cent problematic today, it would have to say in the same breath that with an inflation target of 2 per cent and productivity growth of at least one per cent, all wage growth rates below three per cent were clearly too low.

When it comes to future wage increases, one has to ask why the unions assume that price increases are permanent and that they must consequently try not to be completely left behind in real labour income. Which institution do the trade unions refer to if they want to have a reliable assessment here? If they look at the forecasts and statements of the ECB, they have to note that the ECB considers the price increases to be so serious and so permanent that it concludes that it had no choice but to adopt an extremely strict restrictive course and to maintain this course for the time being. Who can blame the trade unions for wanting to keep the expected real income losses as low as possible? And when they then read that the ECB attributes part of the price increases not to pure cost pass-through but to profit increases, who could blame them for wanting to put an end to redistribution at the expense of workers?

The cat bites the tail (the problem can be seen as an example of the “prisoner’s dilemma”): The trade unions justify their high wage demands with the past high rate of price increases and an expected continued high rate. Conversely, the ECB justifies its restrictive course with the expected high wage settlements, which in turn would lead to a continuing high rate of price increases. In this way, they pass the buck to each other and reject any responsibility for the undesirable developments that will result, namely a decline in much-needed investment and rising unemployment. The theory of inflation expectations, to which the ECB has turned after abandoning flat monetarism, is proving to be the empty formula it has always been. It wants to “anchor” inflation expectations that have got out of hand by raising interest rates sharply, after having encouraged expectations to run out of control through its own misjudgement, and shrugging off avoidable damage to the real economy to do so.

The ECB should have made it clear from the beginning that these are temporary price shocks caused by pandemic and war, which do not require monetary policy intervention if there is no massive acceleration in wage increases. In that case, the collective bargaining parties could have easily come to terms with the situation, as provided for in two major agreements in Germany, with one-off payments and shifts in favour of the lowest incomes that would have had an effect on collective bargaining.

The fact that the labour market situation in Europe is being glossed over, as Isabel Schnabel is doing, does not make things any better. The harmonised unemployment rate in the EMU is still over 6 ½ percent, almost double the American rate, and thus far from a level approaching full employment. In Spain and Greece, the harmonised rates are in double digits, in France, at a good 7 percent, more than twice as high as in Germany, which comes to 3 percent according to the definition of Eurostat or the ILO.

The German rate pulls the average down thanks to the high weight of our country within the EMU. But that does not change the difficult situation people in other countries are facing. After all, the ECB is responsible for all countries in the euro area, not just Germany. Statements like Mrs Schnabel’s feed the suspicion that people are looking exclusively through national glasses. It may be that wage agreements in other countries have already been more unreasonable than in this country. But that would suggest that we should seek dialogue with the wage bargaining parties there instead of impeding the investment process in all EMU countries with the crowbar of “interest rate hikes”. And Germany, we must never forget, is only in a relatively good position because it has pursued mercantilist policies for decades that no other country can imitate.

The extent to which those in charge are floundering when it comes to substantive issues can also be seen in Schnabel’s inclusion of profits in the inflation statement. If companies could raise prices and cause inflation at will, one wonders why they did not do so in the past decade when the ECB was fighting deflation. The ECB could pack it in from the start if there was no competition to force companies to adjust to their cost situation. Then there would be no market economy and no way to fight price increases with high interest rates Because then companies could impose profit margins from which they could pay for every interest rate increase. No, if there is something to a profit-price spiral, it is a case for the antitrust authorities and not for the ECB.

A data-based approach?

Those responsible at the central bank have recently emphasised that they want to follow a data-based approach after another interest rate hike in March, because there is currently no possibility of using economic models to prepare monetary policy decisions. That is a very astonishing statement. All decisions must of course be data-based in the sense that one takes note of empirical developments. But without a clear theory of inflation, the data tell us nothing.

If, as the above statements suggest, the ECB has in the meantime adopted an inflation theory in which wages play a decisive role, its first task must be to explain to the trade unions and the public that without wage acceleration there is no dangerous acceleration of inflation and consequently no monetary policy restriction is necessary. The most important task would then be to distance oneself from the previous interest rate hikes and to withdraw them as soon as the wage partners signal that no wage increases are envisaged that go beyond the middle line of inflation target and productivity growth.

Waiting for data without clearly communicating how one intends to interpret the data is counterproductive. If the central bank simply looks at consumer price growth rates or the so-called core rate and interprets higher rates as inflation without saying what theoretical context it is putting it in, it will soon add new mistakes to the big mistake it has already made.