It was only a matter of time. First, the economic amateurs pounced on the welfare state, now they are attacking the core substance of the economy. As in the 1970s and 1990s, ‘German economic experts’ jump on the ‘tried and tested’ recipes with little delay whenever a crisis arises. People must work more, even without wage compensation (Schularick), we must relax employment protection laws (Reiche), and now, to top it all off, we must reduce overall labour costs in Germany in order to increase competitiveness (Merz).

What Friedrich Merz said at the CSU party conference (found here) is beyond words for many reasons. But what makes it worse is his total ignorance of European affairs. If he and his speechwriters had even the slightest inkling of the reality in Europe, they would have had him say that the euro has appreciated significantly, which is driving up European labour costs in international comparison. He would have had to add that, however, given the American threat of retaliation and a flexible euro exchange rate, it is not clear what can be done about it. Lowering wages across Europe is clearly not a solution, because that would cause the euro to appreciate even more.

He could also have said that Germany had lived far beyond its means in recent decades within the European Monetary Union and now had to tighten its belt. Given Germany’s still huge current account surplus, he would then have been stating the exact opposite of the truth, because Germany has been living below its means for over twenty years, systematically taking in more than it has spent. Even recently, as I have shown here, there was no wage problem.

But even such a lie would have been harmless compared to the blunt and concise statement by the head of government of a country that has broken all the key rules of a monetary union from the outset. To say now that ‘labour costs are too high’ is like a criminal threatening to repeat his crime at any time and without regard for the consequences.

Labour costs and inflation

In a monetary union, the labour costs of the largest country by far cannot be too high without causing inflation. Small countries in the monetary union can plunge themselves into misfortune if their wages and unit labour costs rise too sharply compared to those of the large countries. However, large countries dictate the pace of inflation with their wage setting. If wages in Germany were too high, there would be inflation in Europe. This is inevitable; there is no other option.

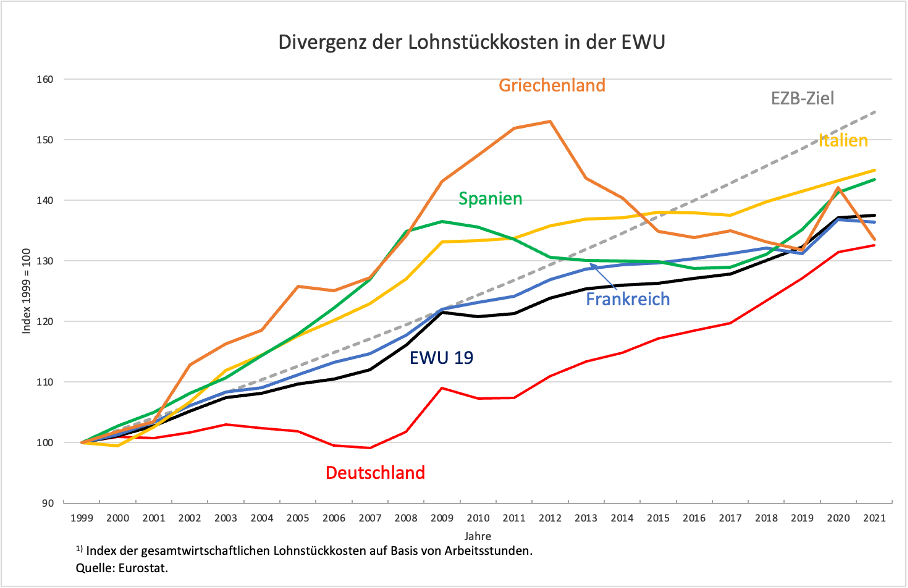

The extent of this effect can be easily seen in the wage reduction policy pursued under Schröder. German wage dumping led to deflationary developments in the EMU, which the ECB had to combat for years with zero interest rates. As the figure shows, Germany, with its ‘role model’, has bent all the unit labor cost curves downwards and thus below the ECB’s inflation target, i.e. into deflationary territory.

In other contexts, Merz always insists on Germany’s greatness and leadership role for Europe. When it comes to economic issues, however, he and his advisers are obviously so uninformed that they do not know what greatness means. The fact that there is no inflation in the EMU and no threat of it is a clear refutation of Merz’s statement.

Falling labour costs and deflation

However, if Germany, against all reason, once again sets out to lower its own wages, even though they have never been ‘too high’, Europe will be driven into the next deflation. This time, however, Germany will gain nothing from it. The other countries will follow Germany’s lead and cut their own wages much more quickly than they did in the first decade of this century, because they have learned how much German policy will sooner or later put them in a predicament if they do not react. This makes wage cuts in Germany completely pointless for Germany and extremely dangerous for the whole of Europe.

What needs to be done?

If the other countries do not take immediate action now and resist Germany’s ideas for improving competitiveness, nothing else will help to improve the economic situation in Europe. Pressure on wages is the worst thing that can happen when demand is weak, which has been the economic picture throughout Europe for years, because it causes massive damage to European domestic demand.

At this point, we must mention the French President. As I pointed out in one of my recent posts, he knows that high foreign trade surpluses are not good for trading partners, but he has only singled out China as a place where he could place his criticism. Germany did not occur to him. Back in Europe, he even knew that the ECB has the wrong mandate because, unlike the US Federal Reserve, it is not explicitly obliged to ensure high employment. Bravo, Monsieur le Président, that is absolutely right (as shown here)! But once again, he forgot to mention that it is the Germans who have been standing in the way of a reasonable assignment of economic policies since the beginning of EMU.

But now it really depends on Macron. If he does not quickly and publicly explain to the Germans that ‘excessive labour costs in Germany’ are a mirage and incredibly dangerous as an economic policy conviction, France can pack its bags. Europe will not survive the next deflationary phase. Everywhere, and first and foremost in France, nationalist forces are coming to power that are systematically bringing Europe to its knees.

However, anyone who thinks that this might not be such a bad thing, given the incompetence with which Europe is currently being led at the political level, is mistaken. Many incompetent people who no longer have any inhibitions about attacking each other are even more dangerous than the current amateur troupe in Brussels.